So, what place do surety products have in your protection strategy? While not every Canadian contracting project will require a surety bond, some public sector projects typically make use of surety bonds for financial protection. The Construction Lien Act was created in 1983, and critics argue it’s time for a change, especially considering payment processes for construction projects are becoming more complex and late payments are on the rise.¹ The idea behind the surety bond mandate is to protect subcontractors – the people who support the project on the ground – from losing out on their prompt payment. The province’s recently tabled Bill 142 to amend the Construction Lien Act has passed into law, and now surety bonds will be required for public projects above a certain dollar amount. However, things have recently changed for contractors in Ontario. While surety bonds are used for a wide range of public and private projects, no legislation calls for all contractors to use them. Does your contracting and construction business need surety? You’ll want to make sure you have appropriate coverage for contractors to protect your company from common claims and losses, regardless of your surety needs. Regardless of whether or not you need a surety bond, you do need insurance, and it’s worth investigating your policy options. And when the customer in a surety agreement is the government, surety can also be considered insurance for the tax-paying public. Instead, surety acts somewhat like insurance for the customer.

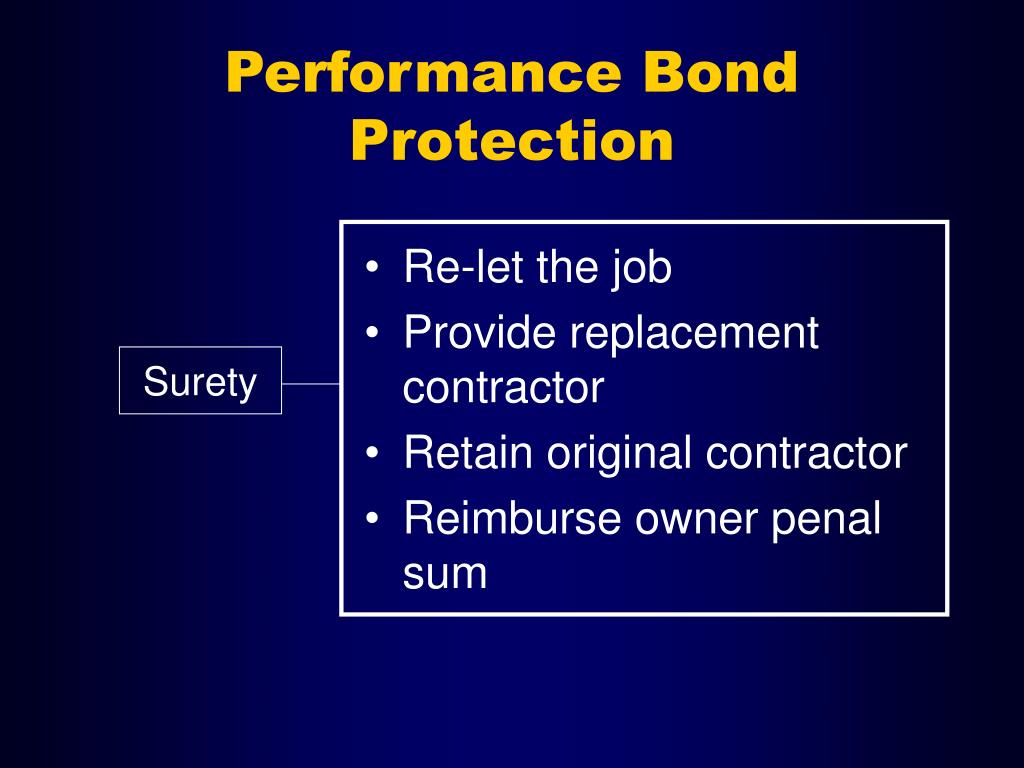

It’s important to remember that a surety bond isn’t the same as – or a replacement for – insurance for your business. Although these bonds take care of your costs, you’re not out of the woods yet – unlike insurance, you’ll eventually have to pay back the entire amount of the bond to the surety provider. In the event of such a default, the surety comes to the rescue with two types of bonds: first, they employ a Performance Bond to complete the work you had started, and then a Labour and Material Payment Bond is used to pay the subcontractors who had been hired. If you (the principal) aren’t able to fulfill the terms and conditions of your contract, a surety provider can make sure that your client isn’t left in the lurch the remaining and consequential costs of the project will be paid on your behalf, so the financial loss doesn’t fall on your client. Large and complex commercial construction projects (such as those where the government is the client) often need a safety net – someone who can guarantee the client that the contractor will fulfill their obligations as laid out in the contract. In this arrangement, you (the business owner) are the principal, and the obligee is your client. A surety agreement involves the principal, the surety, and the obligee. In simple terms, a surety bond is an agreement between three parties, while a traditional insurance policy is an agreement between two. What is a surety bond? Not business insurance! Here, you’ll learn just what is a surety bond, how it’s used, and what it may be able to do for you. While a variety of industries can make use of surety bonds, contract surety for construction and contracting projects is a principal surety product. It’s time to clear up some of the confusion surrounding surety bonding, especially since Canada’s thriving construction and contracting industry could mean greater surety needs down the line. How do you define a surety bond? Is it a form of insurance? Will it protect your company better than another type of policy? In the end, who really benefits from surety products? Surety bonds serve an important purpose, but that purpose isn’t widely understood.

0 kommentar(er)

0 kommentar(er)